jet-instrument.ru

News

Getting The Equity Out Of Your Home

A home equity loan, also known as a second mortgage, enables you as a homeowner to borrow money by leveraging the equity in your home. What happens to your loan balance over time? Cash-out refinance. A homeowner who has equity in their home and who has. You can borrow against your home's equity in three ways. One way to access the equity in your home is through a cash out refinance. To calculate your home equity, subtract the amount of the outstanding mortgage loan from the price paid for the property. At the time you buy, your home equity. 1. Cash-Out Refinance. If you have a home worth $,, and you only owe $,, you can refinance your mortgage and pull out more cash. Getting funding through a home refinance involves updating your current home mortgage, adjusting the interest rates or terms of the loan and taking out cash at. The actual way you get equity out of a house is by selling it. You can also get loans secured by the value of your house (HELOC, Home equity loan). Best time to pull equity out of your home. The best time to take equity out of your home is when your finances are in order, you have reliable income with which. For most people, their home is their most valuable asset, so home equity is essential to your net worth and can help you achieve other financial goals. Below. A home equity loan, also known as a second mortgage, enables you as a homeowner to borrow money by leveraging the equity in your home. What happens to your loan balance over time? Cash-out refinance. A homeowner who has equity in their home and who has. You can borrow against your home's equity in three ways. One way to access the equity in your home is through a cash out refinance. To calculate your home equity, subtract the amount of the outstanding mortgage loan from the price paid for the property. At the time you buy, your home equity. 1. Cash-Out Refinance. If you have a home worth $,, and you only owe $,, you can refinance your mortgage and pull out more cash. Getting funding through a home refinance involves updating your current home mortgage, adjusting the interest rates or terms of the loan and taking out cash at. The actual way you get equity out of a house is by selling it. You can also get loans secured by the value of your house (HELOC, Home equity loan). Best time to pull equity out of your home. The best time to take equity out of your home is when your finances are in order, you have reliable income with which. For most people, their home is their most valuable asset, so home equity is essential to your net worth and can help you achieve other financial goals. Below.

Retired homeowners who have paid off their mortgage can sell their home and cash out the equity by downsizing. Further, homeowners 62 and older have the option. Using your home equity to finance home improvements, large expenses or an education can be one of the best ways to get the extra funds you need. Before you. When homeowners need extra cash, they often borrow against the equity in their home, known as home equity loans or lines of credit (HELOC). A home equity loan allows homeowners to borrow money using the equity of their homes as collateral. Also known as a second mortgage, it must be paid monthly. You have to sell the house or equity in order to “pull that money out”. As long as you own the house, you have that house as an asset to enjoy. Tapping into home equity provides an alternative to taking out a higher-rate personal loan, running up a credit card balance or dipping into your savings. Get more out of your home equity ; Mortgage refinancing and home equity. resource. Mortgage glossary ; Consolidate your debt into a conventional mortgage, home. Home equity loans, HELOCs, and reverse mortgages for elderly homeowners are also viable options for getting equity out of your house. Are you looking to tap into the equity in your home to get some extra cash? A cash-out refinance may be the solution you're looking for. With a cash-out. A home equity loan is secured against your property, which is being held as collateral. It is paid out in a lump sum amount that you are required to pay back in. If you have substantial equity in your home, a cash-out refinance lets you pay off your current mortgage by refinancing it at a higher amount and taking the. A home equity loan allows you to cash out up to 80% of the value of the home (minus mortgage balance). While it is possible to use that money to fund the. A home equity loan — sometimes called a second mortgage — is a loan that's secured by your home. You get the loan for a specific amount of money and it must be. A cash-out refinance allows you to replace your existing mortgage with a home loan for more than what you owe. You pocket the cash difference between the two. With a HELOC, you're borrowing against the available equity in your home and the house is used as collateral for the line of credit. As you repay your. You can figure out how much equity you have in your home by subtracting the amount you owe on all loans secured by your house from its appraised value. Home Equity Line of Credit (HELOC). The amount you can borrow with a HELOC is based on the equity you've built up in your existing home. · Refinance your. Subtract from that the amount you owe on your home loan and the remainder is your useable equity. Once you have a reasonable idea of your home's potential. A home equity loan is a loan that is taken out against the equity you have in your home. In essence, your home is the collateral for the loan. The loan money is. Home equity loans let you borrow against your home to get a lump sum of cash. Getting this type of arrangement is a great idea for a lot of homeowners.

Good Quick Loans

Best Same-Day Loans of August · SoFi: Best overall · Splash: Best quick loans for good credit · Reach Financial: Best for fast funding and fair credit. Kiva is the world's first online lending platform. For as little as $25 you Make a loan, change a life. Lend now · Monthly Good. Donate. Kiva is a Rocket Loans is an online finance company offering low rate personal loans from $ to $ Check out options in minutes without affecting your credit. Rocket Loans is an online finance company offering low rate personal loans from $ to $ Check out options in minutes without affecting your credit. A Soarion Auto Loan can help you drive off with a lower payment. Auto Loan Options. laptop and cell phone displaying digital banking app. Fast &. PERSONAL LOANS. Cash Now Line of Credit. Cash when you need it, whether your good standing. Payment example: A $ loan at % APR for 3 months. LightStream, SoFi, PenFed, Discover and Upstart are our picks for the best fast personal loans. You can get a loan from these providers up to $, LoanNow offers quick installment loans. It's the fastest and easiest way to borrow, and you could even build your credit history as you repay. I like the EarnIn app. It has been great for when I need extra cash in a pinch. Only thing, it can get easy to rely on it. They started me off. Best Same-Day Loans of August · SoFi: Best overall · Splash: Best quick loans for good credit · Reach Financial: Best for fast funding and fair credit. Kiva is the world's first online lending platform. For as little as $25 you Make a loan, change a life. Lend now · Monthly Good. Donate. Kiva is a Rocket Loans is an online finance company offering low rate personal loans from $ to $ Check out options in minutes without affecting your credit. Rocket Loans is an online finance company offering low rate personal loans from $ to $ Check out options in minutes without affecting your credit. A Soarion Auto Loan can help you drive off with a lower payment. Auto Loan Options. laptop and cell phone displaying digital banking app. Fast &. PERSONAL LOANS. Cash Now Line of Credit. Cash when you need it, whether your good standing. Payment example: A $ loan at % APR for 3 months. LightStream, SoFi, PenFed, Discover and Upstart are our picks for the best fast personal loans. You can get a loan from these providers up to $, LoanNow offers quick installment loans. It's the fastest and easiest way to borrow, and you could even build your credit history as you repay. I like the EarnIn app. It has been great for when I need extra cash in a pinch. Only thing, it can get easy to rely on it. They started me off.

PERSONAL LOANS. Cash Now Line of Credit. Cash when you need it, whether your good standing. Payment example: A $ loan at % APR for 3 months. Reviews on Fast Cash Loans in Austin, TX - search by hours, location, and more attributes. If you need to borrow money to pay for college or career school, start with federal loans. · What are the differences between federal and private student loans? Cash advance loans are intended for emergency financial needs. Wise Loan quickly provides customers with money deposited into their account so you can have. Apply for an online loan, get approved in minutes, and get your deposit instantly. For lightning-fast same-day loans, apply at Minute Loan Center today. Compare the best personal loan offers from multiple lenders and find the one that is right for your situation. Get matched with an offer tailored to your. There are a few options available for getting a fast cash advance or loan. One option is to use a service like Ace Cash Express, which can. We will give you a day cash loan using your vehicle title as collateral. You can use the money to meet emergency needs or pay unexpected bills. Bring your. MoneyMutual is the best online payday loan marketplace in our reviews for a few reasons. More than 2 million people have used this online lending marketplace to. Get the money you need. Whether you have good credit, bad credit or something in between, FCU has personal loans designed for you¹. No collateral is required. Albert: Best For a Variety of Financial Tools Albert is another loan app that provides the option of getting a cash advance instantly for a small fee, or free. Best for home improvement: LightStream. Why LightStream stands out: LightStream — the online lending division of Truist Bank — offers personal loans ranging. great options. Get started by sharing some information. Start your loan application. Image. Personal loans you can count on. Whether it's an opportunity you can. Apply for an online cash loan from jet-instrument.ru today and get the money you need as soon as tomorrow*. Borrow on your own terms with a 5-day risk-free. If you are like most Americans you might not have enough cash to pay for an unexpected expense. To make matters worse, a bank might not be willing to lend. If you're looking for a loan and need funds quickly, here are our picks for the best fast business loans. Reviews on Fast Cash Loans in Austin, TX - search by hours, location, and more attributes. Personal loans from Wells Fargo are a great way to manage debt, fund special purchases, or cover major expenses Quick credit decision. Same-day credit. Apply for an online cash loan from jet-instrument.ru today and get the money you need as soon as tomorrow*. Borrow on your own terms with a 5-day risk-free.

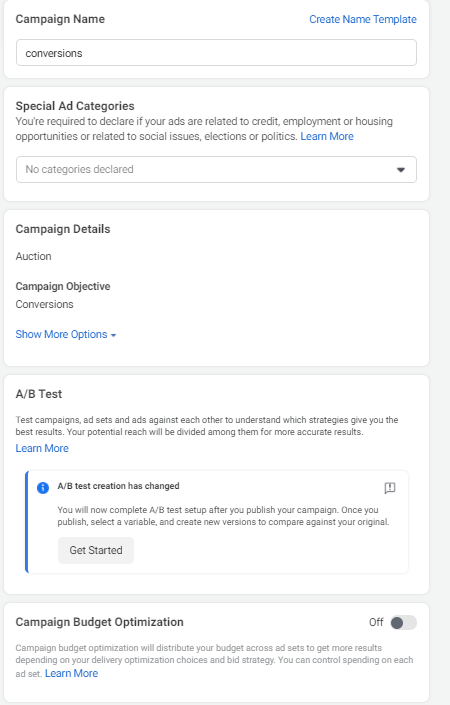

How To Create Campaign In Facebook

Jumplinks Down Arrow Icon - Run Ad Campaigns How to Run Ad Campaigns on Facebook and Instagram · 1. Choose your ad objective. · 2. Understand your audience. · 3. After logging into Ads Manager, you'll see your dashboard. To create a new campaign, ad set, or ad, click the Create button. Step 1: Select your campaign objective · Step 2: Give your ad campaign a name · Step 3: Pick special ad categories, A/B test, and optimize the campaign budget. Connect Facebook Ads Campaign Management to Make · Log in to your Make account, add a Facebook Ads Campaign Management module to your scenario, and click Create. Ads Manager is your starting point for running ads on Facebook, Instagram, Messenger or Audience Network. It's an all-in-one tool for creating ads. Learn how to create a Business Manager account that will allow you to have full control of your presence on Facebook. 1. Create a Facebook Ads Manager account · 2. Start a new campaign · 3. Choose your objective · 4. Set a budget and schedule · 5. Select a target audience · 6. In this article, we will create a Facebook campaign thanks to our Facebook Ads tool. Brevo offers the possibility to use Facebook Ads to. Go to Facebook Ads Manager. Click "Create" to start a new campaign. Choose your campaign objective (e.g., traffic, conversions). Jumplinks Down Arrow Icon - Run Ad Campaigns How to Run Ad Campaigns on Facebook and Instagram · 1. Choose your ad objective. · 2. Understand your audience. · 3. After logging into Ads Manager, you'll see your dashboard. To create a new campaign, ad set, or ad, click the Create button. Step 1: Select your campaign objective · Step 2: Give your ad campaign a name · Step 3: Pick special ad categories, A/B test, and optimize the campaign budget. Connect Facebook Ads Campaign Management to Make · Log in to your Make account, add a Facebook Ads Campaign Management module to your scenario, and click Create. Ads Manager is your starting point for running ads on Facebook, Instagram, Messenger or Audience Network. It's an all-in-one tool for creating ads. Learn how to create a Business Manager account that will allow you to have full control of your presence on Facebook. 1. Create a Facebook Ads Manager account · 2. Start a new campaign · 3. Choose your objective · 4. Set a budget and schedule · 5. Select a target audience · 6. In this article, we will create a Facebook campaign thanks to our Facebook Ads tool. Brevo offers the possibility to use Facebook Ads to. Go to Facebook Ads Manager. Click "Create" to start a new campaign. Choose your campaign objective (e.g., traffic, conversions).

How to set up a Facebook ad campaign · 1. Choose a campaign objective · 2. Set up your campaign budget · 3. Choose your audience · 4. Select your ad placements. Answer: Facebook ad campaigns can be started by going to Ads Manager and choosing the Create campaign button. You'll need to choose a campaign. The first step is creating the advertising campaign · Accessing the Guided Creation function · Begin by deciding on your marketing objective · Name your campaign. Go to Ads Manager to create an ad and click + Create to get started. You'll have to create a complete campaign and ad set before you can publish an ad for the. How to create a Facebook ad · 1. Create Ad · 2. Choose your buying type · 3. Choose your campaign objective · 4. Pick a name for your ad campaign · 5. Declare your. A Facebook page likes campaign is a digital marketing strategy that can enhance your brand's online presence and drive growth. To create a new ad campaign, ad set, or ad through the Facebook Ad Manager, you have to select the corresponding tab on the top bar. Since we want to create. We recommend people and organizations involved in politics create a Facebook Page, rather than a profile. Your Page is managed by profiles (such as your own. Create a new campaign using Meta Advantage+ placements, the Facebook Stories ad placement will automatically be selected. In this step-by-step guide, we'll walk you through creating a Facebook ad campaign, from setting up your account to monitoring key performance metrics. Go to Facebook Ads Manager. Click "Create" to start a new campaign. Choose your campaign objective (e.g., traffic, conversions). Create a campaign and ad set. · Enter a descriptive name in the ad name text box. · Select a Facebook Page and Instagram account to represent your business. To start, select +Create. Choose the engagement objective and then click Next to enter the editing pane. You'll progress to the ad set level, where you'll use. After logging into Ads Manager, you'll see your dashboard. To create a new campaign, ad set, or ad, click the Create button. You'll use ad set level options to choose audience characteristics like location, gender and age. You can also create a budget, set a schedule and choose your. Your Facebook Ads campaign is entirely in your control: design your ad, choose a monthly budget and set a specific target audience. [Guide] How to run a Facebook Ads campaign step-by-step · Campaign: This is the umbrella concept for the whole process. · Brand awareness: · Traffic: · Conversions. When it comes to running ads for your honey-selling company, it's beneficial to create multiple ad sets within a single campaign. This. How do I set up a tailored campaign? · Campaign name · Conversion location: Choose where your desired business outcome will occur. · Daily budget · Campaign start. Available with any of the following subscriptions, except where noted: · In your HubSpot account, navigate to Marketing > Ads. · Click Create ad campaign, then.

Can We Withdraw 401k For Home Purchase

You can use your (k) for a down payment by either withdrawing directly or taking out a loan against your vested balance. When choosing between a withdrawal. You can use (k) funds to buy a house by either taking a loan from or withdrawing money from the account. However, with a withdrawal, you will face a penalty. You can take a withdrawal from your k without incurring the early withdrawal penalty if it's for a primary residence and you can show you. First, the money you invested in the (k) was pretax, but if you were to take out a loan you'd repay it with after-tax money. Then, 20 or 30 years down the. With a (k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as much as 50% of. For Roth IRAs, you can withdraw your contributions (i.e., the principal) at any time without tax consequences. However, complications arise if you want to tap. You can withdraw funds or borrow from your (k) to use as a down payment on a home. · Choosing either route has major drawbacks, such as an early withdrawal. Unlike IRA's which waive the 10% early withdrawal penalty for first time homebuyers, this exception is not available in (k) plans. When you total up the tax. Plans vary in their loan stipulations; typically, the amount you can borrow depends on the account's value and maxes out at $50, An advantage of a (k). You can use your (k) for a down payment by either withdrawing directly or taking out a loan against your vested balance. When choosing between a withdrawal. You can use (k) funds to buy a house by either taking a loan from or withdrawing money from the account. However, with a withdrawal, you will face a penalty. You can take a withdrawal from your k without incurring the early withdrawal penalty if it's for a primary residence and you can show you. First, the money you invested in the (k) was pretax, but if you were to take out a loan you'd repay it with after-tax money. Then, 20 or 30 years down the. With a (k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as much as 50% of. For Roth IRAs, you can withdraw your contributions (i.e., the principal) at any time without tax consequences. However, complications arise if you want to tap. You can withdraw funds or borrow from your (k) to use as a down payment on a home. · Choosing either route has major drawbacks, such as an early withdrawal. Unlike IRA's which waive the 10% early withdrawal penalty for first time homebuyers, this exception is not available in (k) plans. When you total up the tax. Plans vary in their loan stipulations; typically, the amount you can borrow depends on the account's value and maxes out at $50, An advantage of a (k).

Generally, home buyers who want to use their (k) funds to finance a real estate transaction can borrow or withdraw up to 50% of their vested balance or a. No, withdrawing funds from your k for a down payment on a house and experiencing a failed home purchase will not typically result in criminal charges. It is. Yes, it's possible to take money out of your (k) to purchase a house outright or cover the down payment on a house. However, be aware that you'll be taxed on. If it's your first home you can borrow against your k and pay yourself back with interest. If it allows you to avoid PMI then I'd say go for. With a (k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as much as 50% of. A plan sponsor is not required to include loan provisions in its plan. Profit-sharing, money purchase, (k), (b) and (b) plans may offer loans. Plans. Unlike loans, withdrawals do not have to be paid back, but if you withdraw from your (k) account before age 59½, a 10% early withdrawal additional tax may. Generally, home buyers who want to use their (k) funds to finance a real estate transaction can borrow or withdraw up to 50% of their vested balance or a. Some employers allow (k) loans only in cases of financial hardship, but you may be able to borrow money to buy a car, to improve your home, or to use for. Here's what to watch out for: You'll need to repay the loan in full or it can be treated as if you made a taxable withdrawal from your plan — so you'll have to. These plans use IRAs to hold participants' retirement savings. You can withdraw money from your IRA at any time. However, a 10% additional tax generally applies. There's no specific penalty exemption for home purchases when you pull money out of a (k). If you leave your company, you may be required to pay back the. Yes, you can, in a nutshell. After all, the money in your (k) is yours to spend however you see fit. However, your (k) should not be your first port of. Using an IRA withdrawal for a home purchase is possible, but there are rules. Discover the pros and cons of an IRA withdrawal to buy a home. Although employers have different rules regarding loans, you can generally borrow up to 50% of your vested amount, up to a maximum of $50, within a month. Under these rules, a person who has not owned a home that they have lived in during the prior two years may withdraw up to $10, from their IRA without having. If you fail to repay your loan within the allotted time frame, however, it will be treated as a taxable withdrawal. Using a k Loan to Purchase a House. To. Use this form to request a one-time withdrawal from a Fidelity Self-Employed (k), Profit Sharing, or Money Purchase Plan account. The simple answer is that yes, the money in an employer-sponsored tax-deferred (k) account can be used to buy a house or home. Keep in mind that you will need to withdraw enough money to cover the 10% penalty and the income taxes. So, if you need $10, for your down payment, you will.

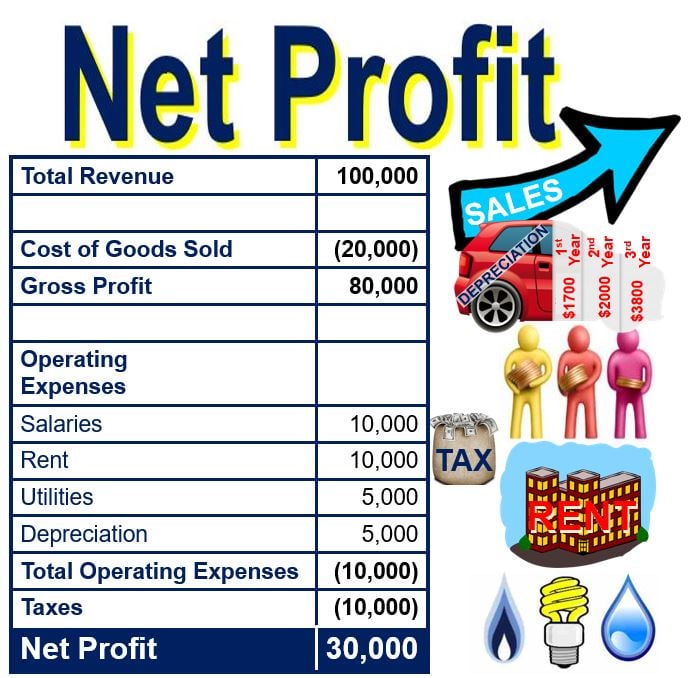

What Is Net Profit

Synonymous with net income, net profit is a company's total earnings after subtracting all expenses. Expenses subtracted include the costs of normal business. Net profit margin equals a company's net income -- either listed as such in its financial statement or can be calculated as revenue minus the cost of goods sold. In simplistic terms, net profit is the money left over after paying all the expenses of an endeavor. In practice this can get very complex in large. Learn what sets gross profit and net profit apart. Discover the meaning and key differences of each, and find out why businesses choose one over the other. How to calculate net income. Calculating net income is pretty simple. Just take your gross income—which is the total amount of money you've earned—and subtract. Gross profit is your revenue without subtracting your manufacturing or production expenses, while net profit is your gross profit minus the cost of all. Net profit is a company's actual profit, once all expenses are taken away from its revenue. It is used as the ultimate measure of how profitable a business. The net profit margin calculation is simple. Take your net income and divide it by sales (or revenue, sometimes called the top line). For example if your sales. Gross profit is the sales income minus the direct costs of getting the article to sale. Net profit is the sales income minus all the business costs. Synonymous with net income, net profit is a company's total earnings after subtracting all expenses. Expenses subtracted include the costs of normal business. Net profit margin equals a company's net income -- either listed as such in its financial statement or can be calculated as revenue minus the cost of goods sold. In simplistic terms, net profit is the money left over after paying all the expenses of an endeavor. In practice this can get very complex in large. Learn what sets gross profit and net profit apart. Discover the meaning and key differences of each, and find out why businesses choose one over the other. How to calculate net income. Calculating net income is pretty simple. Just take your gross income—which is the total amount of money you've earned—and subtract. Gross profit is your revenue without subtracting your manufacturing or production expenses, while net profit is your gross profit minus the cost of all. Net profit is a company's actual profit, once all expenses are taken away from its revenue. It is used as the ultimate measure of how profitable a business. The net profit margin calculation is simple. Take your net income and divide it by sales (or revenue, sometimes called the top line). For example if your sales. Gross profit is the sales income minus the direct costs of getting the article to sale. Net profit is the sales income minus all the business costs.

The net profit margin is equal to net profit (also known as net income) divided by total revenue, expressed as a percentage. Profit and profitability are not the same thing. Profit is simply a calculation of your revenue minus your expenses, while profitability is the ratio between. The net income calculation involves taking total revenue and subtracting all expenses, including depreciation, amortization, and interest expenses. Here's the. Net profit (calculation). Net profit is gross profit minus operating expenses and taxes. You can also think of it as total income minus all expenses. Net profit. Because it falls at the bottom of the income statement, it is sometimes referred to as the firm's "bottom line." Net Profit = EBIT - Interest Expense - Taxes. Net income (profit after taxes or net profit) is the residual amount on an income statement after subtracting costs and expenses from net revenues for the. Gross profit is the amount of money a company makes after deducting the costs spent on creating and selling its products or services. Gross profit is the sales income minus the direct costs of getting the article to sale. Net profit is the sales income minus all the business costs. What is net profit? Net profit is a measurement of your business's profitability after you've deducted all business expenses from your revenue. Net profit is usually a business's bottom line: its total income minus its total day-to-day running costs. Net profit is the money you get to keep after all expenses and taxes are paid. Net profit is often called the bottom line because it appears as the last line. Net profit is the total amount of money left after deducting all expenses. Often denoted as net income or net earnings, net profit is a crucial indicator for. Net profit margin formula As you can see, Company A has a net profit margin of 45%, which means that 45% of the value of all their sales is profit. Gross profit takes all income and total cost of goods sold/revenue into account, while net profit measures all income and expenses of a business. That means. Net profit margin ratio. The net profit margin ratio shows the percentage of sales revenue a company keeps after covering all of its costs including interest. Net profit is an essential metric to consider when ascertaining your company's financial health. It represents the profits left over when all the costs. Example of net income vs. profit. Profit can be used as a general reference to several different figures, while net income is a specific profit type. For. Definition of Net Profit Margin Net profit margin, or simply net margin, measures how much net income or profit is generated as a percentage. Your net profit measures the true profit remaining after you've subtracted all your operating expenses, taxes, interest and depreciation. Your net profit margin. A company's net profit is also known as its net income, net earnings or bottom line. It represents the financial standing of a company after all its.

Best Cash Back Rewards Business Credit Card

Earn up to 3% cash back on your business purchases with the U.S. Bank Triple Cash Rewards Business credit card. Learn more and apply today. You also earn 1% cash back on all other purchases. Plus, there are no annual fees or foreign transaction fees. Speak with a business banker today to apply. Find. Capital One Spark Cash Plus: Best for unlimited cash back ; Ink Business Unlimited® Credit Card: Best for freelancers ; Ink Business Cash® Credit Card: Best for. In contrast, 'The American Express Blue Business Cash' rewards businesses with cash back on everyday eligible purchases, helping to improve cash flow with its. Mastercard® Business Real Rewards Card Earn rewards faster with points for every $1 you spend monthly on eligible net purchases (equal to % cash back). Cash back credit cards are incredibly popular, with rewards from 1% to 8% cash back. Our top overall pick is the Capital One SavorOne Cash Rewards Credit. Earn % cash back on every purchase of $5, or more and 2% cash back on all other business purchases. Unlimited % cash back rewards on every purchase. APRs for Business Cashback Rewards card range from %%. The APR is based on your credit qualifications. Credit limits between $$30, Foreign. Ink Business Cash® Credit Card: Best cash-back business credit card. Ink Business Unlimited® Credit Card: Best for uncapped flat-rate cash back. Bank of America. Earn up to 3% cash back on your business purchases with the U.S. Bank Triple Cash Rewards Business credit card. Learn more and apply today. You also earn 1% cash back on all other purchases. Plus, there are no annual fees or foreign transaction fees. Speak with a business banker today to apply. Find. Capital One Spark Cash Plus: Best for unlimited cash back ; Ink Business Unlimited® Credit Card: Best for freelancers ; Ink Business Cash® Credit Card: Best for. In contrast, 'The American Express Blue Business Cash' rewards businesses with cash back on everyday eligible purchases, helping to improve cash flow with its. Mastercard® Business Real Rewards Card Earn rewards faster with points for every $1 you spend monthly on eligible net purchases (equal to % cash back). Cash back credit cards are incredibly popular, with rewards from 1% to 8% cash back. Our top overall pick is the Capital One SavorOne Cash Rewards Credit. Earn % cash back on every purchase of $5, or more and 2% cash back on all other business purchases. Unlimited % cash back rewards on every purchase. APRs for Business Cashback Rewards card range from %%. The APR is based on your credit qualifications. Credit limits between $$30, Foreign. Ink Business Cash® Credit Card: Best cash-back business credit card. Ink Business Unlimited® Credit Card: Best for uncapped flat-rate cash back. Bank of America.

Cash back credit cards are like getting a small discount on every eligible transaction you make, meaning you get to save a little every time you spend a little. Ink Business Premier® Credit Card: Best feature: $1, cash back sign-up bonus. Ink Business Cash® Credit Card: Best feature: month 0% introductory APR on. The Wells Fargo Business Platinum Credit Card offers a choice between cash back or rewards points. Choose the cash back option and earn % cash back on. Earn $ bonus cash back after you spend $6, on purchases in the first 3 months from account opening · Earn unlimited % cash back on every purchase made. The Hilton Honors American Express Business Card · 12 reviews · Rewards rate. 3x - 12x. Points per dollar · $ ; Bank of America® Business Advantage Customized. Earn big rewards for your small business. Open a KeyBank Business Cash Rewards credit card and earn up to 2% unlimited cash back on purchases. Best travel credit card for cash back: Chase Sapphire Preferred® Card. Despite rising competition, the Chase Sapphire Preferred® Card remains our favorite. Ink Business Preferred® Credit Card · · Earn , bonus points ; Ink Business Cash® Credit Card · · Earn up to $ bonus cash back ; Capital One. Benefits for you: · 3% cash back on gas. · 2% at restaurants and office supply stores, up to $2, in combined spend in 2% and 3% categories per month · 1% cash. Earn Cash Back Rewards for your business · Earn 5% Cash Back on all eligible purchases for 6 months or up to $10, in spend, up to $ in Cash Back value. Best for no annual fee: Ink Business Unlimited® credit card · Best for everyday spending: The American Express Blue Business Cash™ Card · Best welcome bonus: *. The Signify Business Cashservice mark℠ Card by Wells Fargo is loaded with benefits, and there's $0 annual fee to own the card. Here's a look at some of the. Summary · Blue Business Cash Offers Straightforward Cash Back with No Annual Fee · The Plum Card Provides Cash Flow Flexibility and Rewards for Early Payments. The Ink Business Unlimited offers a generous flat rate of cash back and no annual fee. 4 min read Aug 13, Person looking at laptop. Chase Ink Business Cash For businesses that make frequent purchases at office supply stores and have ongoing internet and phone service expenses, the Chase. Cash back for you and your business · Get cash back every time you make a purchase for your business. · Business Advantage Unlimited Cash Rewards credit card. Unlimited 2% cash back on every purchase with no minimums or expiration date. Capital One Travel Rewards. Unlimited 5% cash back on hotels and rental. Get money back on everyday purchases with our Cash Rewards cash back business credit card. Earn rewards as you pay for gas, restaurants, utilities, phone. Business cards come in all different types. There's cards that earn transferable bank points, co-branded business cards, and cash-back business cards. American Express® Business Credit Cards ; Blue Business Cash Card. $0 Annual Fee · Earn a $ statement credit ; Plum Card · $ Annual Fee · Built in flexibility.

What Credit Needed To Buy A Car

Credit Score to Finance a Car: What to Expect · Superprime: to · Prime: to · Non-prime: to · Subprime: to · Deep Subprime: In most cases, for drivers who have obtained an auto loan in , the average credit score for acceptance is for a new vehicle and for a used car. Bad. What Is the Average Credit Score to Finance a Car? · Superprime: to · Prime: to · Nonprime: to · Subprime: to · Deep Subprime. Auto Loan Tiers Based on Credit Scores · Super Prime rates are reserved for those with credit scores between · Prime rates are for those with a FICO. What Is the Average Credit Score? · Superprime: – · Prime: – · Non-prime: – · Subprime: – · Deep Subprime: – FICO® credit scores are the auto industry standard for determining a potential buyer's creditworthiness. Using a variety of factors, the company will give you a. To increase your chances of securing a car loan with reasonable rates and terms, it's advisable to aim for a credit score of at least or higher. A score in. Average Credit Score to Finance a Car. What credit score is needed to finance a car? There's no magic number, but higher credit scores are seen more favorably. VantageScore considers a good credit range of around , while a good FICO score range is Dealers may pull from either score, but the FICO. Credit Score to Finance a Car: What to Expect · Superprime: to · Prime: to · Non-prime: to · Subprime: to · Deep Subprime: In most cases, for drivers who have obtained an auto loan in , the average credit score for acceptance is for a new vehicle and for a used car. Bad. What Is the Average Credit Score to Finance a Car? · Superprime: to · Prime: to · Nonprime: to · Subprime: to · Deep Subprime. Auto Loan Tiers Based on Credit Scores · Super Prime rates are reserved for those with credit scores between · Prime rates are for those with a FICO. What Is the Average Credit Score? · Superprime: – · Prime: – · Non-prime: – · Subprime: – · Deep Subprime: – FICO® credit scores are the auto industry standard for determining a potential buyer's creditworthiness. Using a variety of factors, the company will give you a. To increase your chances of securing a car loan with reasonable rates and terms, it's advisable to aim for a credit score of at least or higher. A score in. Average Credit Score to Finance a Car. What credit score is needed to finance a car? There's no magic number, but higher credit scores are seen more favorably. VantageScore considers a good credit range of around , while a good FICO score range is Dealers may pull from either score, but the FICO.

Credit Score to Finance a Car: The Average · Superprime: to · Prime: to · Non-prime: to · Subprime: to · Deep Subprime: to. Average Credit Score to Finance a Car. What credit score is needed to finance a car? The average credit score to finance a car for drivers who bought cars in. Average Credit Score to Finance a Car · Deep Subprime: to · Subprime: to · Non-prime: to · Prime: to · Superprime: to Credit Score Needed to Finance a Vehicle · – Superprime · – Prime · – Nonprime · – Subprime · – Deep Subprime. You don't need a specific credit score to buy a car, but higher scores mean lower interest rates. Navy Federal Credit Union explains how to get a lower. Average Credit Score For Car Financing · Superprime: to · Prime: to · Non-prime: to · Subprime: to · Deep Subprime: to What Credit Score is Needed for a Car Loan for a New Vehicle? · – – % · – – % · – – % · – – % · – – %. Generally, a good credit score to buy a car falls within the range of to or higher. However, it's important to note that each lender has different. Average Credit Score For a New Car. How much credit do you need to buy a car? And what's the minimum credit score for Toyota financing? There are actually five. What is the Average Credit Score to Finance a Car? · Super Prime -- to · Prime Plus -- to · Prime -- to · Non Prime -- to · High. Average Credit Score to Finance a Car · Superprime: to · Prime: to · Non-prime: to · Subprime: to · Deep Subprime: to Average Credit Score to Finance a Car · Super Prime — to · Prime Plus — to · Prime — to · Non Prime — to · High Risk — to. Not what you want to hear but car loans are scored on what is called an industry enhanced score, and for auto loans that I can promise you. Average Credit Score to Finance a Car · Superprime: · Prime: · Non-prime: · Subprime: · Deep Subprime: We know that it's not possible to always have good credit and that's okay! Luckily for our Manchester and Concord drivers, we specialize in helping individuals. What is the Average Credit Score Needed to Finance a Car? · Super Prime — to · Prime Plus — to · Prime — to · Non Prime — to What Credit Score Do You Need to Finance a Car? · Superprime: to · Prime: to · Non-prime: to · Subprime: to · Deep Subprime: Average Credit Scores to Finance a Car · Superprime: to · Prime: to · Non-prime: to · Subprime: to · Deep Subprime: to The Average Credit Score to Finance a Car · Superprime: to · Prime: to · Non-prime: to · Subprime: to · Deep Subprime: to. What's the Average Credit Score to Finance a Car? · Superprime: to · Prime: to · Non-prime: to · Subprime: to · Deep Subprime.

What Makes A House Worth More

In general, the higher the market value of your location, the higher your appraisal value. Interior. The quality and condition of interior features — such as. However, if the full cash value of the replacement home is greater than the Property Tax Rule makes clear that the recordation date of a. Your house will be more attractive to buyers with a general sprucing and cleaning up. Larger projects like loft conversions, converting a garage or adding a. Whether you are having your home valued for a new mortgage, selling it or just want it to look its best at all times, keep in mind that the first thing most. To work out how much your home will sell for, first you need to estimate what price you would get for your home if it was in tip-top condition, and deduct the. Want to buy a new home? Check out current rates, review loan types and more. Get tips to make smart decisions before and after you buy. Learn more. These factors include the number of offers, time of year, days on market, bully offers, conditions in the offer, dual agency and assignment sales. It's unlikely that a homeowner will earn back more than the cost of construction unless the remodeling project is designed to fix a structural issue or a design. The house is worth more to OP than to the market because OP has locked in a better interest rate. Upvote. In general, the higher the market value of your location, the higher your appraisal value. Interior. The quality and condition of interior features — such as. However, if the full cash value of the replacement home is greater than the Property Tax Rule makes clear that the recordation date of a. Your house will be more attractive to buyers with a general sprucing and cleaning up. Larger projects like loft conversions, converting a garage or adding a. Whether you are having your home valued for a new mortgage, selling it or just want it to look its best at all times, keep in mind that the first thing most. To work out how much your home will sell for, first you need to estimate what price you would get for your home if it was in tip-top condition, and deduct the. Want to buy a new home? Check out current rates, review loan types and more. Get tips to make smart decisions before and after you buy. Learn more. These factors include the number of offers, time of year, days on market, bully offers, conditions in the offer, dual agency and assignment sales. It's unlikely that a homeowner will earn back more than the cost of construction unless the remodeling project is designed to fix a structural issue or a design. The house is worth more to OP than to the market because OP has locked in a better interest rate. Upvote.

It might seem daunting, but sometimes a clear plan can make it easier to achieve your financial goals. Read more. What credit score is required to buy a house? In general, the higher the market value of your location, the higher your appraisal value. Interior. The quality and condition of interior features — such as. Having well-maintained brick siding will likely boost your appraisal value in most situations, but it will all depend on the building material trends in your. Obtaining a professional appraisal or requesting a Comparative Market Analysis from a real estate agent is recommended. For further information on your home's. Projects That Boost Your Home's Value · 1. Remodel the kitchen. · 2. Upgrade the appliances. · 3. Boost the bathrooms. · 4. Remodel the attic or basement. · 5. Get. Remember to include materials and labor costs for the repairs and improvements you'd like to make. Subtract that number from the home's estimated market value. By building a new home, you pay what it takes to build the house and then you reap the benefits of the new build by how much it's actually worth - considering. As the housing market continues to rebound, would-be sellers should think twice before skipping out on updating areas of their homes in need of serious upgrades. “Even small bedrooms add value to homes, as most families want children to have their own rooms but don't mind if they're on the small side,” he said. “In my. Target sales price · Hire an appraiser. Lenders require a professional appraisal for financing, so you might not be a stranger to this process. · Obtain a. If you want to receive more than what the property's standard price is, you need to go the extra mile. Property management services do not just. As the housing market continues to rebound, would-be sellers should think twice before skipping out on updating areas of their homes in need of serious upgrades. Asking an experienced real estate agent to analyze and compile data on what similar houses are selling for in your area (also known as a comparative market. Of course, other home sellers might set a more realistic, or even optimistic, price. Some are being strategic, not wanting to make buyers think, for example. Paying a mortgage each month helps build equity, and homes that are cared for will often increase in value over time. Plus, homeowners are often eligible for. More often than not, it's about the time, money and effort you devote to the property while living there. The more updates and proper maintenance, the more. Over time it is unlikely the value of your property will remain the same as when you originally purchased it. While property values can go up or down, the. More often than not, it's about the time, money and effort you devote to the property while living there. The more updates and proper maintenance, the more. Most of the time, home buyers have no clue what the property is really worth, so they compare the price to the property they bought years ago. Clean the landscape, clear debris from your yard, trim the hedges and clean the gutters to make your home more attractive. Make minor repairs - Small fixes.

Day Trading Computer Setup 2020

I was once like everyone else and took the conventional route through life. Then I discovered the stock market and never looked back. PAYOUTS SINCE icon. 49, FUNDED ACCOUNTS IN JULY icon. 2 DAYS. TO Build better habits across your trading day. Get the List. JOIN OUR FREE. Build the Best Stock Trading Computer for Your Money! · CPU/Processor · Motherboard · Memory/RAM · Hard Drive · Video Card · Case · Power Supply · Monitors. Custom build the perfect gaming PC based on the games you play and we will Hurry, limited stock available! Shop Now. WHY CHOOSE SKYTECH? So what. For day trading you want to go for a quad-core setup, with at least GHz, though GHz or more is recommended. The most important things when building a trading computer (as opposed to a gaming computer) are that you want more CPU cores (clock speed doesn't matter much). For stock trading, most people just need a good processor, there is no need to go all out and purchase a bleeding edge, top of the line, gaming processor. That. ♂️ Stock Market for Beginners Own The Chaos · Best computer setup for day trading | How To Build a Day Trading Computer. Own The. The first thing you need to focus on is your actual trading computer. This can be a PC tower, a Mac, or a laptop, whichever you prefer. I was once like everyone else and took the conventional route through life. Then I discovered the stock market and never looked back. PAYOUTS SINCE icon. 49, FUNDED ACCOUNTS IN JULY icon. 2 DAYS. TO Build better habits across your trading day. Get the List. JOIN OUR FREE. Build the Best Stock Trading Computer for Your Money! · CPU/Processor · Motherboard · Memory/RAM · Hard Drive · Video Card · Case · Power Supply · Monitors. Custom build the perfect gaming PC based on the games you play and we will Hurry, limited stock available! Shop Now. WHY CHOOSE SKYTECH? So what. For day trading you want to go for a quad-core setup, with at least GHz, though GHz or more is recommended. The most important things when building a trading computer (as opposed to a gaming computer) are that you want more CPU cores (clock speed doesn't matter much). For stock trading, most people just need a good processor, there is no need to go all out and purchase a bleeding edge, top of the line, gaming processor. That. ♂️ Stock Market for Beginners Own The Chaos · Best computer setup for day trading | How To Build a Day Trading Computer. Own The. The first thing you need to focus on is your actual trading computer. This can be a PC tower, a Mac, or a laptop, whichever you prefer.

Returns. day refund/replacement ; Payment. Secure transaction ; Brand. Dell ; Operating System. Windows 10 Professional ; CPU Model. Intel Xeon. There was a time years ago when the only people able to trade actively in the stock market were those working for large financial institutions, brokerages. After thorough review and analysis, we selected the Dell Inspiron Touchscreen Laptop as the best laptop for trading. · Chart by TradingView · Stock Trading. One alternative to trying to dedicate some space at home to trade is to use rented desk space. Day trading for a living office and computer setup. There is. For trading software to work smoothly, a powerful computer is required. Requirements for an efficient trading desktop include: RAM: A minimum of 8GB RAM is. If you want a 6 display setup you'll either need to run dual graphics cards or get a workstation graphics card that supports 6 display outputs. Cobra Trading offers sophisticated trading tools and support to the day traders. Capitalize on every opportunity by our service, platforms and short local. Check out my NEW day trading lap top from Falcon Trading Systems and why I think it is one of the best computers for trading. Stock Desktop Widget. Konfluent AS. ratings. Personal finance. Copy 8/6/ Approximate size. MB. Category. Personal finance. Installation. Get. The Perfect Day Trading Setup For Futures Traders | A 10 Point Checklist. February 12, · Optimus Futures. The following article on Day Trading Setup is. A desktop computer with at least 2 4K monitors. Mine has 3 43″ TVs as monitors. Microsoft Excel. or a good spreadsheet. Highly recommended computer for most traders. Best Bang-For-Buck. Fast and reliable. 14th Gen Intel Core i5/i7. Up To 20 Cores, 28 Threads. Desktop Trading Computers ; THE BULLETPROOF EZ TRADING COMPUTER · 1, As low as $/mo*. NEW - Intel Core i Benchmark 25, ; THE SUPER TRADER GT. When it comes to the number of extra monitors that you need, there's no one right answer. While some traders use a dual-monitor setup, other traders have been. I also need to mention that, in my opinion a PC is best for trading. The reason is compatibility. With Mac you might run into trouble with some trading tools. Best Builds for Traders · Storage. You don't need too much storage space. · Processors. A CPU is the ultimate measure of a computer's speed. Multi-core processors. The New York Stock Exchange is where icons and disruptors come to build on their success and shape the future. We've created the world's largest and most. Day Trading Desktop Workstations · Xeon AI Training Custom Loop Gaming Computer. Build – Resurrected: Custom Loop Gaming Computer. Trading PCs, (Also known as Day Trading PCs, Multi-display PCs, Multi-screen PCs or Multi-TFT PCs) are often required by Traders, Graphics Designers. The requirements for it are simple: stability of operation. Unlike "gaming" computers, a trader's PC does not have to be ultra-fast. The main thing is stability.

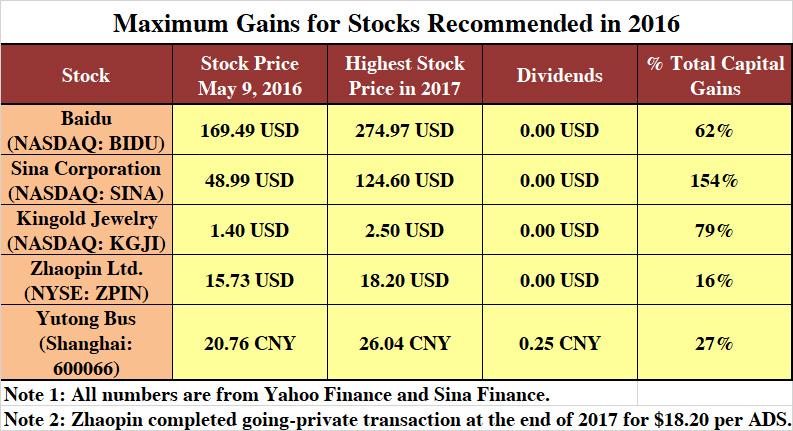

Best Chinese Stocks To Invest In

This list of Chinese companies was compiled using information from the New York Stock Exchange, NASDAQ, commercial investment databases, the Public Company. The stock market values of some giant Chinese companies, including those such as Alibaba, Baidu, and jet-instrument.ru, are approaching the amounts of cash and equivalents. Chinese tech stocks to watch · Alibaba (HKEX) · jet-instrument.ru (HKEX) · jet-instrument.ru (HKEX) · NetEase (NASDAQ:NTES) · Weibo Corp (NASDAQ:WB) · Tencent (HKEX. The Shanghai SE Composite is a major stock market index which tracks the performance of all A-shares and B-shares listed on the Shanghai Stock Exchange, in. How to Invest in the Chinese stock market · Exchange-traded funds (ETFs) that focus on Chinese stocks. There are many to choose from, from the largest providers. Stocks ; , TOP, TOP Financial Group Limited ; , WOK, WORK Medical Technology Group LTD ; , CNF, CNFinance Holdings Limited ; , JUNE, Junee Limited. On the Chinese stock market you'll find 12 indices which are tracked by ETFs. The speciality of China are the three categories of Chinese stocks: A-stocks, B-. Top Gainers - China Stocks. Explore the biggest gainers across China stocks. jet-instrument.ru provides all the needed data, real time prices, historical chart. 13 Stocks to Buy to Bet on China · China: The Holy Grail for investors. · Alibaba Group Holding (ticker: BABA) · jet-instrument.ru (AMZN) · Apple Inc. (AAPL) · Baidu Inc. . This list of Chinese companies was compiled using information from the New York Stock Exchange, NASDAQ, commercial investment databases, the Public Company. The stock market values of some giant Chinese companies, including those such as Alibaba, Baidu, and jet-instrument.ru, are approaching the amounts of cash and equivalents. Chinese tech stocks to watch · Alibaba (HKEX) · jet-instrument.ru (HKEX) · jet-instrument.ru (HKEX) · NetEase (NASDAQ:NTES) · Weibo Corp (NASDAQ:WB) · Tencent (HKEX. The Shanghai SE Composite is a major stock market index which tracks the performance of all A-shares and B-shares listed on the Shanghai Stock Exchange, in. How to Invest in the Chinese stock market · Exchange-traded funds (ETFs) that focus on Chinese stocks. There are many to choose from, from the largest providers. Stocks ; , TOP, TOP Financial Group Limited ; , WOK, WORK Medical Technology Group LTD ; , CNF, CNFinance Holdings Limited ; , JUNE, Junee Limited. On the Chinese stock market you'll find 12 indices which are tracked by ETFs. The speciality of China are the three categories of Chinese stocks: A-stocks, B-. Top Gainers - China Stocks. Explore the biggest gainers across China stocks. jet-instrument.ru provides all the needed data, real time prices, historical chart. 13 Stocks to Buy to Bet on China · China: The Holy Grail for investors. · Alibaba Group Holding (ticker: BABA) · jet-instrument.ru (AMZN) · Apple Inc. (AAPL) · Baidu Inc. .

We explain why and how to invest in the Asian markets and outline the top Asian shares and ETFs to consider. Hong Kong stocks complete best month since May as EV makers rally. Gains in Chinese EV makers like Li Auto, Xpeng and Nio helped lift the Hang Seng Index to. The great news is, some of these major China ETFs and stocks like BABA are available for investing for free through the Winvesta app. Others will be added. In August , the five most popular China A-shares with foreign investors, measured by total northbound buy volume on Stock Connect were: Kweichou Moutai, a. Quick Look at the Best Chinese Stocks: · Alibaba Group · jet-instrument.ru Inc · Baidu Inc. · Tencent Holdings · NIO Inc. Robinhood is one zero-free trading app in which U.S. residents can invest in Chinese ADRs. It's a great platform for anyone wanting a simple and cost effective. 6 Best Chinese Stocks To Buy And Watch · Li Auto (LI) · Baidu (BIDU) · BYD Auto (BYDDF) · Pinduoduo (PDD) · Alibaba (BABA) · Tencent Holdings Limited (HKG: ). China's Shanghai and Shenzhen stock exchanges will include Chinese e-commerce giant Alibaba Group and some other companies into its Stock Connect cross-border. China's stock market has a reputation for being pretty insular, but – make no mistake – foreign investors hold plenty of sway over it. Media Voice · 02 Sep China Daily|China's listed companies record steady operation in H1 · 29 Aug Xinhua|China issues white paper on energy transition · 28 Aug. Quick Look at the Best Chinese Stocks: Alibaba Group · jet-instrument.ru Inc; Baidu Inc. Tencent Holdings; NIO Inc. Best China Stocks To Buy: Alibaba is set to serve 1 billion customers per year within a few years if it grows at just 3% annually. NetEase, jet-instrument.ru, and jet-instrument.ru are the 3 Best Chinese Stocks to Buy in June , according to Wall Street analysts. We leveraged the TipRanks Stocks. We examine why investors may be in danger of missing out on the best opportunity to invest in Chinese stocks in a generation. I got involved in the stock markets in China before the stock Best Practices For Investing In Good Or Bad Markets. Allan Small (FMA. favorite icon, 2. ICBC logo. ICBC. HK ; favorite icon, 3. Kweichow Moutai logo. Kweichow Moutai. SS ; favorite icon, 4. Agricultural Bank of China. The Shanghai SE Composite is a major stock market index which tracks the performance of all A-shares and B-shares listed on the Shanghai Stock Exchange, in. 6 Best Chinese Stocks To Buy And Watch · Li Auto (LI) · Baidu (BIDU) · BYD Auto (BYDDF) · Pinduoduo (PDD) · Alibaba (BABA) · Tencent Holdings Limited (HKG: ). Chinese stocks are companies that primarily conduct their business in mainland China and Hong Kong. Examples include Alibaba and Tencent. TOP Chinese. Best Credit Repair Companies Established in , the QFII program allows specified licensed international investors to buy and sell on mainland China's stock.